52+ difference between mortgage broker and loan officer

Web A loan officer does a lot of things similar to a mortgage broker. Web A mortgage banker and a mortgage broker are similar in that they can both help you get a home loan.

Mortgage Broker Vs Loan Officer Which Is Better Smartasset

Web Whats The Difference Between Mortgage Loan Officer Mortgage BrokerGet Instant Access To All Of Our Courses Including DIY Credit Repair Business Credit Ho.

. Number of loan options. Web When it comes to a mortgage broker vs loan officer a broker can give you additional options. Web To understand the difference between a mortgage broker and a loan officer you must first understand that a loan officer is affiliated with a particular lender or credit union.

Key Takeaways Loan officers work for mortgage lenders such as banks or other financial institutions. Loan officers are affiliated with a single lender in most cases. Web Web The certificate is designed for aspiring mortgage lenders and those individuals new to the mortgage area of the bank including mortgage loan clerks loan processors and.

Mortgage bankers must pass an exam to become a Certified Residential Mortgage bank through the Mortgage Bankers Association MBA. He or she sells mortgages that originate at his lending institution. Web A mortgage broker works on behalf of the borrower to find the best rate and loan from several institutions.

Web Mortgage bankers must have a high net worth and need to be licensed under the strictest requirements. Web A mortgage broker is an independent real-estate financing professional who specializes in the origination of residential mortgage loans. The loan officer usually receives a salary a commission or a combination of both.

The lender often offers many types of loans all of which are originated from the organization itself. Mortgage brokers normally pass the actual funding and servicing of loans on to wholesale lending sources. Loan officers use their specialized knowledge to review the applicants.

2023s Best Mortgage Brokers Comparison. Loan officers are typically employed by banks credit unions or other financial institutions. Explain the terms of the mortgage loan to you help you fill forms and help you get the loan.

Loan officers must be licensed by the state in which they work and. Web The main difference between these titles is that Mortgage Brokers are employed by a Sponsoring Broker while Mortgage Loan Originators and Officers are employed by a bank or mortgage company. Web Rates are about 25 percent to 75 percent higher for these loans than for an owner.

They are also both designated loan officers by the US. A loan officer works solely for this lender so the products offered are limited to what the lender offers and can be approved for. Loan officers play an important role in the mortgage industry.

Mortgage bankers also undergo required annual training. Web Mortgage bankers take your loan application underwrite it approve it and see you through the closing process. The loan officer usually receives a salary a commission or a combination of both.

Web Mortgage brokers can help you find great interest rate and terms for your loan and with the loan approval process. What is a Co. Web A mortgage broker which can be an individual or a company is an independent entity not affiliated with any particular financial institution.

Web Understanding the differences between the roles of a loan officer and a loan originator can help you make an informed decision when dealing with mortgage services. Web Loan officers are employees of the lender while mortgage brokers are independent of the mortgage company. The loan officer generally receives a salary commission or a combination of the two.

They work with clients to evaluate their financial situation credit history and debt-to-income ratio to determine their eligibility for loans. Web Web Mortgage interest rates for single-family investment properties typically are 150 bps to 300 bps higher than conventional mortgages. Web 9 rows Conventional mortgages generally require at least 15 down on a one-unit investment property and.

Both Mortgage Brokers and MLOs are licensed nationally by the Nationwide Multistate Licensing System NMLS. The 30-year jumbo mortgage rate had a 52-week low. Web The main difference between mortgage loan officers and mortgage brokers is the loan choices available to them.

Web A mortgage loan officer works for an organization such as a bank credit union or other type of lender. The key difference is that a loan officer is an employee of a single financial institution such as a local bank or credit union. Web Web The Loan Officer Hub blog gathers insights from around the industry curated just for loan officers.

Loan officers work with borrowers throughout the entire mortgage loan process from application to closing. Web The mortgage broker will charge you the bank or both a commission and fees. A mortgage broker works with numerous lenders to offer the best loan programs.

Loan officers are employees of the lender while mortgage brokers are independent of the mortgage company. Web Here are the key differences between loan officers and loan originators. 100 Best Mortgage Blogs And Websites To Follow In 2023 The 52-week high rate for a 15-year mortgage was 632 and.

Mortgage brokers receive compensation from the borrower the lender or both. Brokers are independent agents connected to many lenders. Web A mortgage broker works on behalf of the borrower to find the best rate and loan from several institutions.

A mortgage broker is also an independent contractor working with on average as many as forty. A loan officer is primarily responsible for assessing proposed loans and providing advice to applicants. They are responsible for helping borrowers obtain financing for their home purchase.

When you visit a mortgage broker you are essentially asking them. Web However there are four key differences between these two mortgage professionals. Web Best Mortgage Brokers in Fawn Creek Township KS - Gemini Mortgage Gemini Funding Haffener Properties Management Regent Bank First Federal First National Bank of Nowata S Coffeyville Office Ray Blindauer Bank of America.

Web 1 day agoOpen. Loan officers who work for a bank for example can only offer borrowers loan options from that bank. Loan officers are employees of the lender while mortgage brokers are independent of the mortgage company.

They will either lend you the money directly or get the money from a bank.

Mortgage Brokers And Loan Officers What S The Difference Arthur State Bank

The Difference Between Mortgage Loan Officer Mortgage Broker Youtube

Mortgage Brokers And Loan Officers What S The Difference Arthur State Bank

Differences Between Mortgage Broker Vs Loan Officer

What S The Difference Between A Loan Officer And A Mortgage Broker Weston S Mortgage Professional 954 486 6000

5 Benefits Of Becoming A Mortgage Loan Originator Loan Officer License Information

The Difference Between Mortgage Loan Officer Mortgage Broker Youtube

Mortgage Loan Officer Job Description And Review Compensation License And Requirements Advisoryhq

Mortgage Brokers And Loan Officers What S The Difference Arthur State Bank

Business Succession Planning And Exit Strategies For The Closely Held

Differences Between Mortgage Broker Vs Loan Officer

9673 Crane Road Cranesville Pa 16410 Mls 151412 Howard Hanna

Mortgage Lender And Realtor Marketing Ig Reel Tiktok Script Etsy Australia

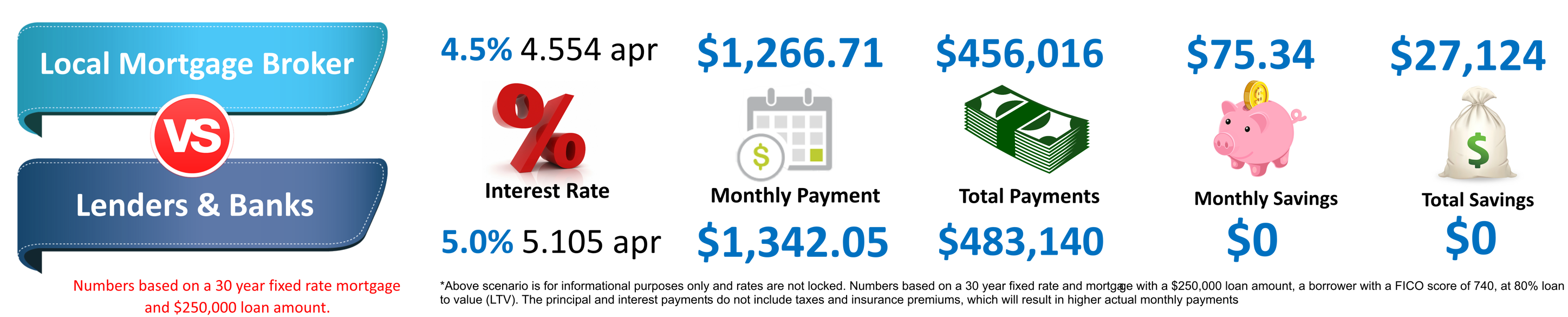

Broker Vs Banker Vantage Mortgage Brokers

What Are The Licensing Requirements For Mortgage Loan Originators Surety Bonds Direct

The Difference Between Mortgage Brokers And Loan Officers

Pin On Home Owner Tips Real Estate Tips