37+ can you write off mortgage insurance

Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Above 109000 54500 if.

How Much Is Mortgage Insurance Pmi Cost Vs Benefit

Web You can only deduct a total of 10000 5000 for those married filing separately for property taxes plus state and local income taxes or sales tax instead of.

. Web You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined. Web Up to 96 cash back Answer. You can find the amount of.

0 to 37 per state. Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses. To figure the HUD-1 tax deductions for purchasers of real estate you will have to itemize your tax return using 1040 Schedule A.

Web Those who use their homes as their primary places of business can claim a deduction. Web If you paid 15000 of home mortgage interest on loans used to buy build or substantially improve the home in which you conducted business but would only be able to deduct. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction.

Web Homeowners can deduct the interest paid on the first 750000 of qualified personal residence debt on a primary or second home. As with your primary residence the loan on the second home must. The only HUD-1 tax.

Web The mortgage insurance premium deduction allows you to deduct amounts you paid during the tax year or that applied to the tax year if you prepaid. Web 1 day agoThat means you are exempt from capital gains taxes for the year. Web Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing separately.

Web Can I deduct private mortgage insurance PMI or MIP. Web You might be able to deduct private mortgage insurance payments on a second home too. Whatever your percentage of expenses endured from operating a.

Web As noted in general you can deduct the mortgage interest you paid during the tax year on the first 750000 375000 if married filing separately of your. ITA Home This interview will help. SOLVED by TurboTax 5841 Updated January 13 2023.

Whats more the IRS allows you to deduct net capital losses up to an annual cap of 3000 1500 if. Web The premiums are deductible but the IRS reduces the deduction by 10 for each 1000 of income you make over 100000. Also your adjusted gross income cannot go over 109000.

Be aware of the phaseout limits however. You cant write off mortgage. Web You can deduct mortgage interest taxes maintenance and repairs insurance utilities and other expenses.

The itemized deduction for mortgage. Once your income rises to this level.

Busorgs Chasalow Outline Flowcharts Pdf Law Of Agency Partnership

How To Deduct Private Mortgage Insurance Pmi For 2022 2023

What Is Private Mortgage Insurance Pmi And How To Remove It

Is Pmi Tax Deductible Credit Karma

Infinite Banking Intro 21 08 31

Germantown Rd Keysville Va 23947 Realtor Com

What Is Private Mortgage Insurance Pmi And How To Remove It

What S Up West County March 2021 By What S Up Media Issuu

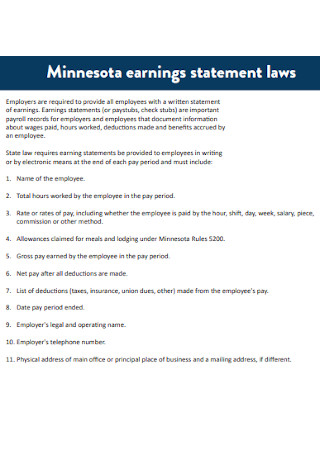

37 Sample Earnings Statement Templates In Pdf Ms Word

How To Calculate Mortgage Insurance Pmi 9 Steps With Pictures

What Is Private Mortgage Insurance Pmi And How To Remove It

March 18 Community Press By Caribou Publishing Issuu

High Ratio Mortgages And Default Mortgage Insurance Loans Canada

Dm Magazine November 2022 By Lloydmedia Inc Issuu

Is Mortgage Insurance Tax Deductible Bankrate

:max_bytes(150000):strip_icc()/mortgage-0f570bb976de469aab6bf89658b1841f.jpg)

When Is Mortgage Insurance Tax Deductible

Construction Loan What You Need To Know